EXL Services is an Associate Member of PACB.

By Daniel Yakimenko and Anurag Mukherjee – EXL

Major disruptions:

We live in interesting times, in which one unprecedented event follows another. Four years back, COVID-19 affected all aspects of our lives and changed the way enterprises do business, including the debt management and debt collection industries. While the pandemic is behind us, we believe that changes in customer behavior and expectations have changed permanently. In fact, the segment of customers with high-digital activity and with expectations of an “Amazon like” experience from every brand they interact with has grown rapidly for the last three years across every industry. Such customers expect the same digital and personalized experiences in their debt collections interactions as well.

And the signs of a potentially big problem:

With the geo-political turmoil and macroeconomic issues facing many parts of the interconnected world, we have started to see a surge in delinquencies. The question is this: Are we as a lender or financial institution equipped to deal with a scenario where delinquencies are surging, customers are expecting a digital debt collections experience and we need to reduce or vary our operating costs?

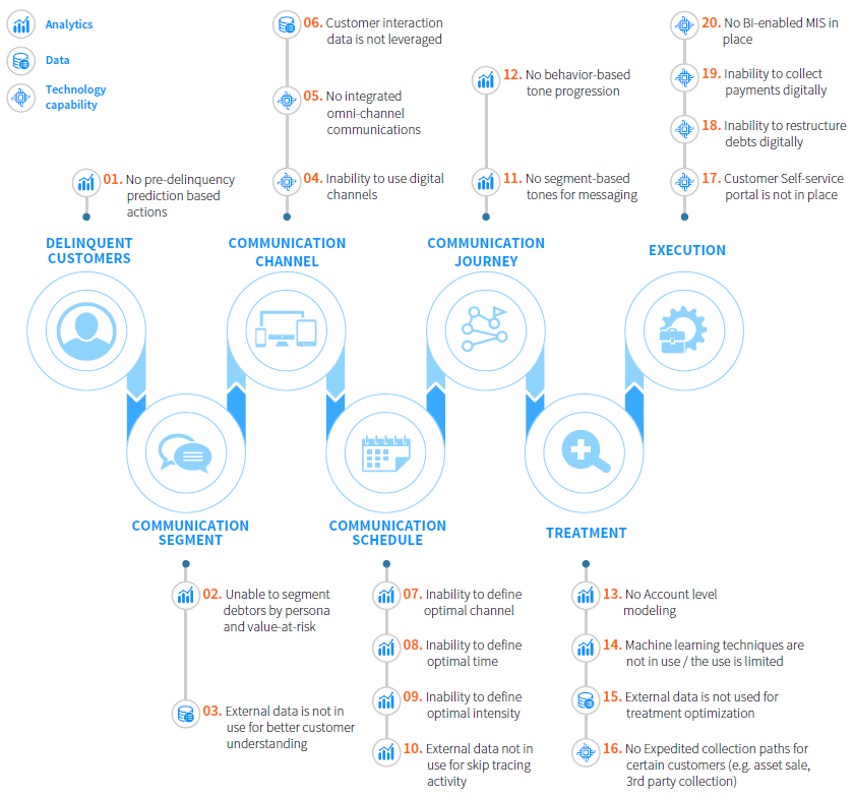

To help you answer that question, we have produced a list of 20 symptoms or capability gaps that, if not addressed, can result in poor collections outcomes and an extremely poor debt collections experience for your customers. If you have fewer than 10 of these symptoms, your debt collections capabilities need a relook, and if you have more than 10 of these 20 symptoms, then your capabilities need an immediate and significant overhaul

Potentially disastrous consequences:

Our point of view is that if you see many of the above symptoms and choose to ignore them, you run the risk of higher credit loss, increased collections costs and poor customer experience. Most lenders intentionally do not invest in upgrading their in-house debt collections capabilities including going digital, because a) they underestimate the impact on customer experience and therefore their brand and b) they think that third-party agencies will do this for them.

However, as the earlier recession scenarios have shown, agencies have no incentive to digitize and improve collections capabilities, and therefore are unable to collect from lenders’ portfolio with the increased intensity and efficiency needed in a difficult macroeconomic scenario. We strongly believe that lenders need to take charge and invest in building a scalable and digital collections capability to be able to successfully navigate the difficult and uncertain times ahead.